newsletter

Your Daily News in Just 5 Minutes!

Featured

Featured

Realē Happy Empowers Investors to Scale with BRRRR Method While Maintaining Cash Flow Transform Your Real Estate Journey

Realē Happy Empowers Investors to Scale with BRRRR Method While Maintaining Cash Flow—Transform Your Real Estate Journey!

Jan 30, 2025

Nationwide – January 31, 2025 (USANews.com) – Realē Happy, a leader in real estate investment education and mentorship, is helping investors maximize profits through the Buy, Rehab, Rent, Refinance, Repeat (BRRRR) method—all while minimizing common cash flow challenges. By combining expert strategies, smart financing solutions, and exclusive partnerships, Realē Happy makes it easier for investors to scale their portfolios strategically.

Unlocking the Power of BRRRR While Managing Cash Flow

The BRRRR method has revolutionized real estate investing, allowing investors to acquire properties, increase their value, and refinance to pull out capital for future deals. However, many face hurdles such as cash flow constraints, lender limitations, and refinancing challenges, which can stall portfolio growth.

Realē Happy addresses these challenges by providing:

✅ Strategic Financing Solutions – Helping investors secure the right lenders, loan structures, and creative financing options to optimize cash flow.

✅ Step-by-Step BRRRR Guidance – A proven framework to navigate property selection, renovation, and refinancing with minimal risk.

✅ Exclusive Market Insights – Data-driven property analysis to help investors buy in high-appreciation, high-rent areas.

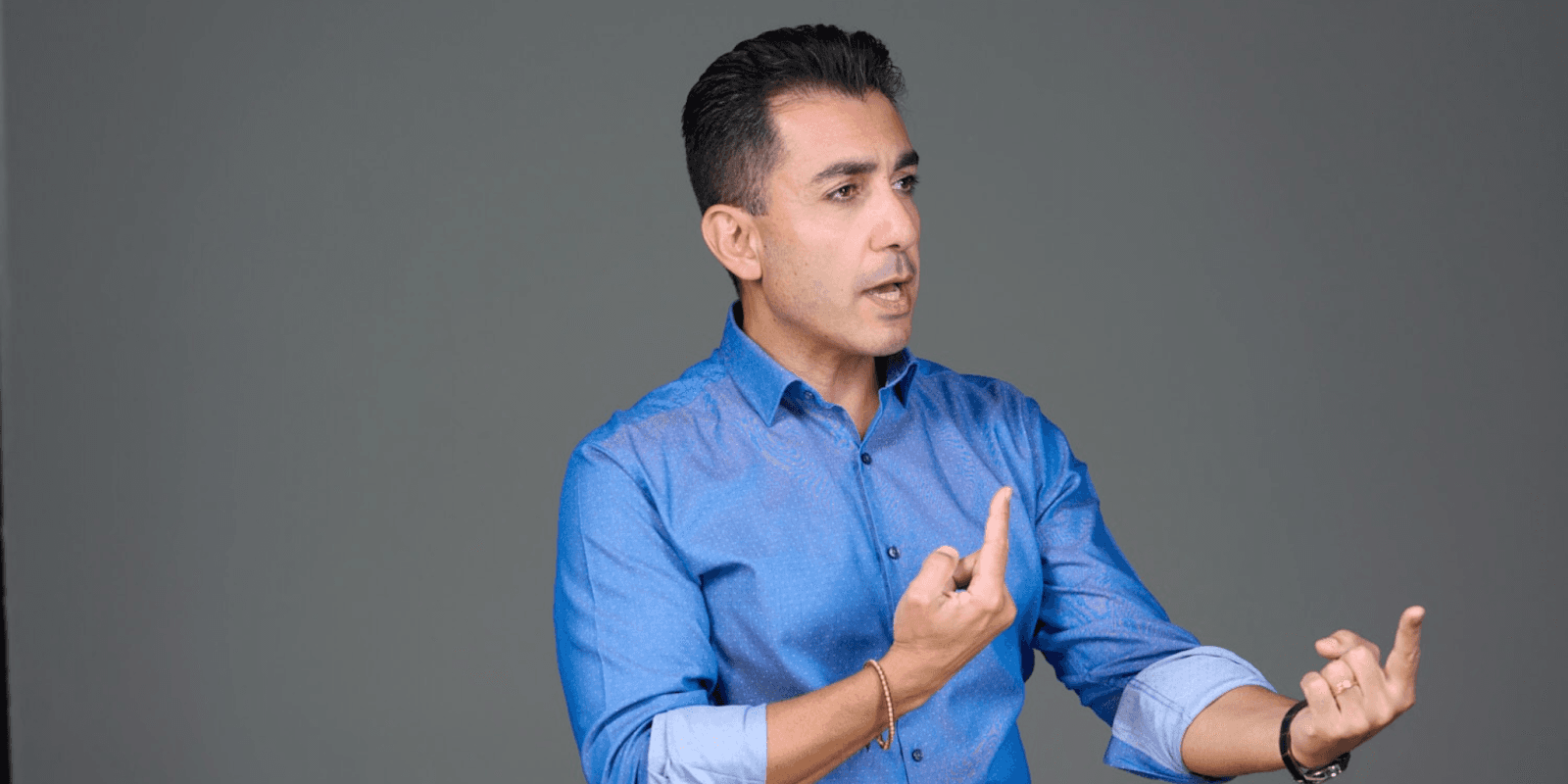

"Many investors get stuck after their first or second deal because they either run out of liquidity or struggle with refinancing," said Hawk Mikado, CEO of Realē Happy. "We provide the right tools, funding strategies, and expert guidance to help investors continue scaling—without hitting a financial wall."

The Key to Scaling: Smart Lending & Refinancing Strategies

One of the biggest challenges BRRRR investors face is securing the right refinancing terms or working with lenders that fully support real estate investors. Realē Happy connects investors with a network of experienced lenders who offer:

🔹 Investor-Friendly Loan Programs – Refinancing options that help investors extract capital while maintaining positive cash flow.

🔹 Bridge Loans & Hard Money Lending – Short-term financing solutions to keep investors moving through the BRRRR cycle.

🔹 Creative Financing Strategies – Seller financing, private lending, and other innovative approaches that allow investors to scale efficiently.

"Many people believe they need hundreds of thousands of dollars in capital to build a portfolio, but with the right BRRRR execution and financing strategies, investors can reinvest the same initial funds multiple times," said Hawk Mikado.

A Track Record of Investor Success

Realē Happy has helped numerous investors successfully implement the BRRRR method, allowing them to build multi-property portfolios with minimal upfront capital.

Investor Success Story:

Jane Smith, a first-time investor, purchased her first BRRRR property with $30,000 in savings. By following Realē Happy’s strategy, she refinanced, pulled out her initial investment, and reinvested in two additional properties within a year—expanding her portfolio without needing additional capital from her savings.

"I thought I needed more money to keep going, but Realē Happy showed me how to use refinancing and smart leverage to scale my portfolio. Now, I own four properties and have built a growing passive income stream!" – Jane Smith, Realē Happy Investor

About Realē Happy

Realē Happy is a premier real estate investment education platform dedicated to helping investors achieve financial freedom through scalable, strategic investing. With expert mentorship, exclusive financing partnerships, and a data-driven approach, Realē Happy empowers investors to build long-term wealth while avoiding common pitfalls.

For media inquiries, interviews, or partnership opportunities, please contact:

Media Contact:

Hawk Mikado

Realē Happy

Phone: 1-800-123-4567

Email: info@realehappy.com

www.realehappy.com

Related blogs

Related blogs

Copyright 2025 USA NEWS all rights reserved

newsletter

Get daily news directly in your inbox!

Copyright 2025 USA NEWS all rights reserved

newsletter

Get daily news directly in your inbox!

Copyright 2025 USA NEWS all rights reserved

Copyright 2025 USA NEWS all rights reserved