Ben Hung Multimillionaire: Defying all odds – One of the best youngest trader investor in the UK

Ben Hung Multimillionaire turned £250 into £18 million through disciplined investing, mentorship, a contrarian approach, and going against the crowd strategies.

By

Feb 20, 2026

Ben Hung Multimillionaire’s journey from a modest beginning to becoming one of the most successful traders in the world showcases the power of persistence, strategy, and unconventional thinking in the financial markets. Starting with just £250, he built a significant fortune through disciplined investing.

Using his 30 growth strategies, he outperformed the market big time by buying technology stocks in 2020,2021, energy stocks in 2022 when interest rises, and then swap into tech/communication stocks in 2023,24, and metal gold silver stocks in 2025, and energy stocks in 2026

The Humble Beginnings

Ben Hung Multimillionaire was born into a family facing significant financial challenges. His early life was marked by financial insecurity, which had a lasting impact. From a young age, Ben witnessed the toll that money struggles took on his family and felt the pressure to change his situation. While his parents hoped he would follow a traditional career path in fields like being an Asian Doctor, lawyer or engineer, Ben pursued a different path, focusing on his education and striving to make a difference for his family. After graduating from Imperial College London, Ben entered the workforce, hoping his degree would provide financial stability. However, reality proved more difficult, as he worked long hours in a demanding job that left little room for personal fulfillment or family time.

The loss of a close family member to a breast cancer was a turning point for Ben as he didn’t get to say goodbye to her as he was too busy working. It pushed him to reassess his life and seek a new path to success.

The Shift to Trading

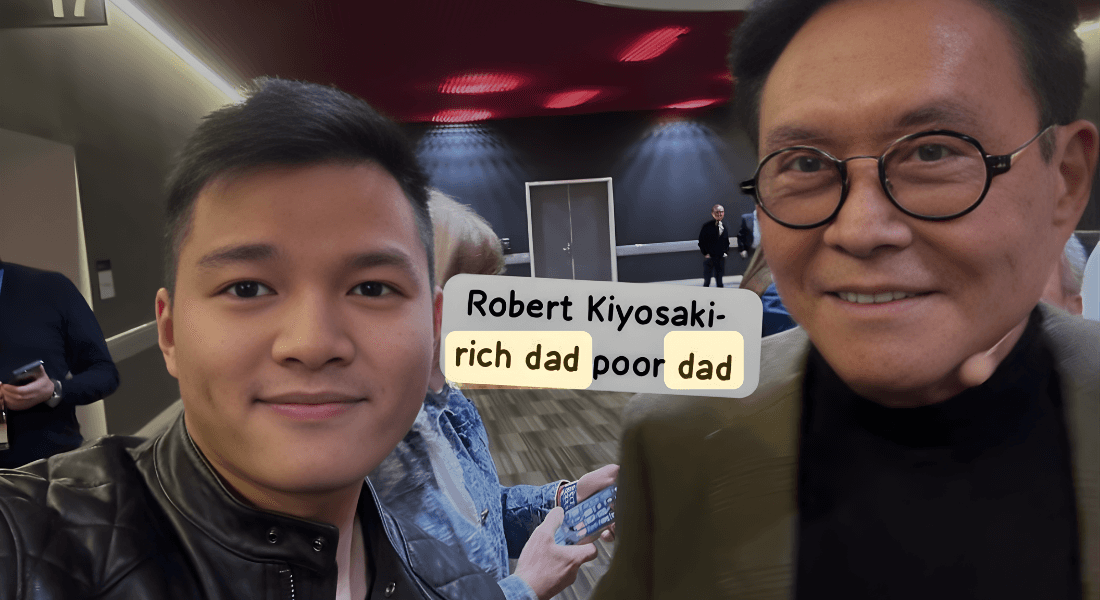

At a low point in his life, Ben discovered trading. Although initially inexperienced and making many mistakes, he didn’t give up. Instead, he committed to learning and improving his skills. Over time, he absorbed information from more than 500 books, attended investment training courses worldwide, and borrowed money to fund his education. Ben’s commitment led him to secure 1to1 mentorship from some of the greatest traders investors alive, which eventually became the breakthrough he needed.

The 8-Step Strategy

Starting with just £250, Ben applied the strategies he learned from his 1to1 mentors, combining them with his own research. Over the course of several years, his initial investment grew substantially. Ben developed an 8-step strategy that combined disciplined investing, deep research, and a contrarian approach to the market. His ability to invest across asset classes such as commodities, currencies, bonds, and stocks became his defining edge.

The Principles That Set Ben Apart

Ben’s success is grounded in a few key principles that guide his approach to investing:

The "10 Baby Stocks" Strategy: By focusing on a select group of high-growth stocks, Ben ensures that his investments deliver strong returns on equity. He concentrates his efforts on this small group, allowing for greater precision in his decisions.

The Cross-Asset Class Advantage: Ben loves sector rotation strategy like buying energy stocks in 2022 when market crash, then swap back to technology stocks and gold/silver when trumps was in charge. Unlike many investors who focus solely on equities, Ben is adept at moving across multiple asset classes. This flexibility gives him an advantage, as he is able to identify opportunities across different markets.

Contrarian Thinking: Ben believes the greatest opportunities are often found by going against popular opinion. When something seems too obvious, it may already be priced into the market. Ben’s success comes from identifying opportunities that others overlook.

The Risks and Rewards of Ben’s Approach

Ben believes in the value of taking bold actions, even in the face of fear. He frequently quotes, “Fortune favors the bold,” emphasizing that the greatest risk is not taking any risks at all.

Giving Back: Beyond Wealth Accumulation

Ben’s success is not only measured by his wealth. He is passionate about giving back, believing that wealth should serve a greater purpose. As a philanthropist, Ben enjoys the joy that comes from helping others. He also mentors a select group of 1to1 students, many of whom have gone on to achieve financial success using his 8-step strategy.

How Ben’s Strategy Can Work for You

Ben Hung Multimillionaire’s story demonstrates that success in investing doesn’t come from playing it safe. Exceptional returns are a result of bold action, long-term vision, and disciplined execution. For those looking to learn from his strategies, Ben’s key advice includes:

Take action immediately, even if fear is present.

Invest in education, learning is the key to success.

Seek mentorship, having a 1to1 guide is essential when learning a new skill.

Ben’s story shows that financial success is possible with the right strategy, education, and mindset.

Current Status:

Ben Hung Multimillionaire, now a successful trader investor, no longer accepts new one-on-one students, as he is focused on mentoring a select group of private 17 students, through his company Investment Success Ben Academy Ltd, where he shares his strategies with committed individuals.

Investment Success Ben Academy Ltd

Name: Ben Hung Multimillionaire – Multimillionaire Trader & Investor

Email: info@investingchampions.com

WhatsApp: 07519501616

Website: www.benhung.co.uk

Disclaimer:

This article is for informational purposes only and is not intended to promote, encourage, or provide professional advice related to investing, trading, or financial strategies. Always consult a qualified professional or trusted authority before engaging in any activities related to investing or trading, especially if doing so may have legal, financial, or personal consequences. The author and publisher are not responsible for any losses, damages, or outcomes resulting from the use or reliance on the information provided.