Building Financial Resilience: Strategies Combining Property, Loans, and Alternative Assets

Building financial resilience requires using property for income, leveraging loans, diversifying with alternative assets like gold, and optimizing debt.

By

Jan 30, 2026

You can’t predict money these days. Prices rise, interest rates change, and investments that looked safe yesterday can lose value tomorrow. If you rely on just one source of income or one type of investment, you’re vulnerable when things shift.

The key to staying secure is building a financial setup that works in different situations, gives steady income, and grows over time. Using property, loans smartly, and alternative assets like gold or other tangible investments together can do this.

In the blog, we’ll look at how these tools can protect your money, create income, and help you stay in control no matter what the economy does.

1. Leverage Property for Cash Flow

Rental properties are more than just places to live, they’re tools for building steady income. When you buy a property and rent it out, the rent you collect can cover the mortgage, taxes, insurance, and maintenance, while leaving extra cash for savings or reinvestment. This is called positive cash flow, and it’s the foundation of building financial resilience.

Timothy Allen, Sr. Corporate Investigator at Oberheiden P.C. adds, “Even small oversights in tenant agreements or property management can create bigger problems down the line,” said Timothy Allen. “Much like investigating corporate risks, careful documentation and attention to detail in rentals protects your income and ensures cash flow stays predictable.”

For example, buying a small apartment in a city with high rental demand can generate extra income. If rent is $1,500 and your expenses total $1,200, you have $300 left each month. Over a year, that's $3,600, which can be saved for another property, used for emergencies, or invested elsewhere.

Location matters too. Cities with growing populations, job opportunities, and good amenities have lower vacancy rates and more stable rents. Even small investments in these areas can yield reliable cash flow. Monitoring market trends, tenant demographics, and keeping leases up to date strengthens financial stability and reduces risk.

Raj Dosanjh, CEO of RentRound, adds, “Managing a property may sound like extra work, but with tenants paying rent every month, your property can become a machine that steadily grows your savings while also increasing in value over time.”

2. Use Mortgages Strategically

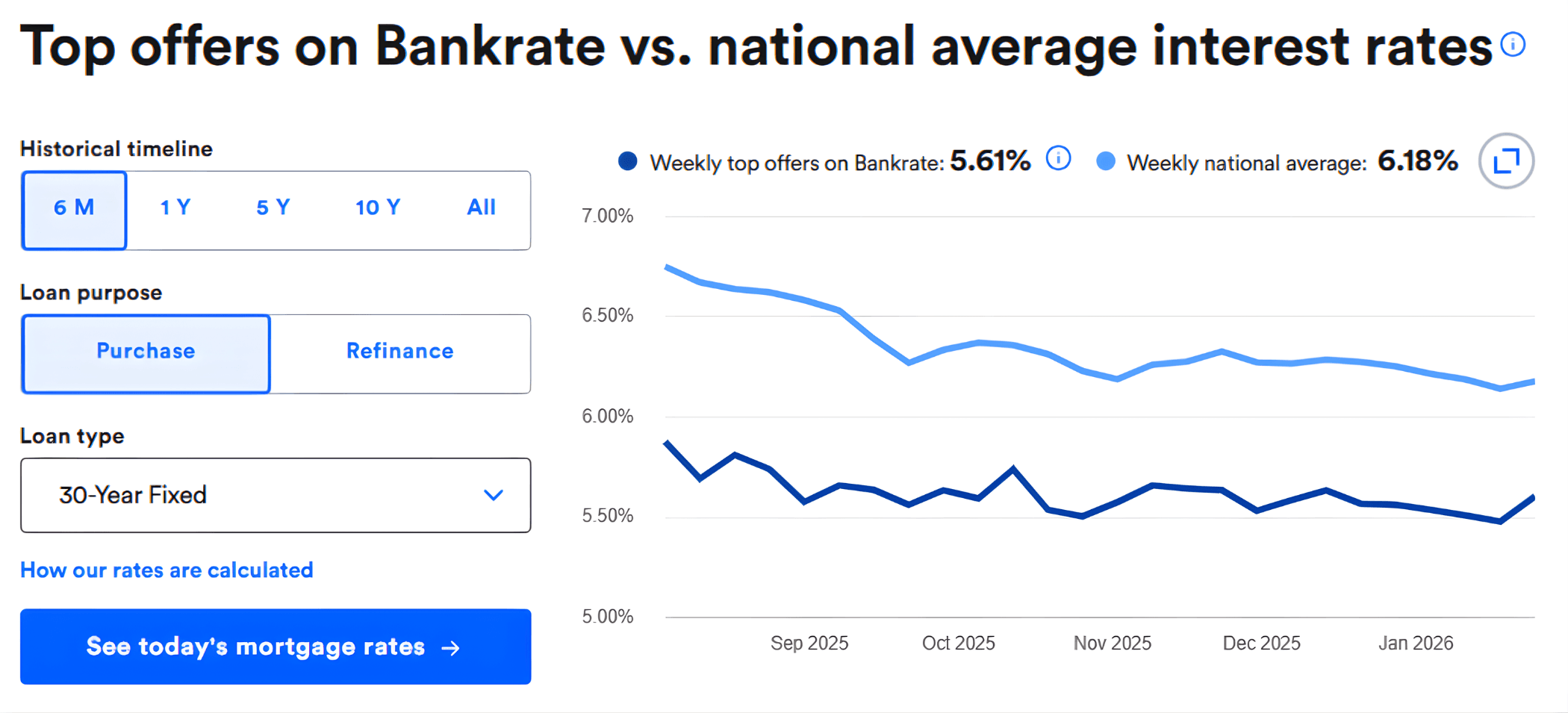

Mortgages are a way to multiply your buying power. By taking advantage of low-interest loans, you can acquire real estate without tying up all your cash. Right now, the average 30-year fixed mortgage rate in the U.S. is around 6.18%, which is historically low compared to rates in the 1980s that were over 15%.

Image Source: Bankrate

Using a loan at today’s rates lets you invest in properties while keeping cash available for emergencies or other opportunities.

Smart financing means understanding leverage. Borrowed money amplifies returns, but you must also account for repayment plans and affordability.

Coral Jacobs, Founder & Business Owner of AJ Home Loans Gladstone, adds, “For many first-time investors, the key is knowing how much mortgage you can comfortably manage. It’s not just about low rates, understanding your payments, potential rent, and cash flow ensures your investment grows steadily without stretching finances too thin.”

For example, if a property brings in $2,000 per month in rent and your mortgage payment is $1,500, the $500 surplus provides flexibility. You can reinvest it, cover unexpected costs, or pay down the loan faster.

3. Diversify Across Asset Classes

Relying on a single type of investment can leave a portfolio exposed to unexpected shifts. Combining real estate with alternative assets like gold, silver, or other tangible investments spreads risk and creates long-term stability. Real estate generates steady income and potential appreciation, while metals act as a safeguard when other markets fluctuate.

Raja Ravel, Bridging Loan Broker & Lead Adviser at BridgeLoanDirect.co.uk, says, “Diversification isn’t just about splitting money between assets, it’s about understanding how financing and leverage interact with market cycles. A well-structured loan on a property, paired with defensive assets like gold, creates a buffer that protects cash flow even when one market underperforms.”

For example, during a stock market downturn, real estate may experience slower appreciation, but gold often retains value or even rises. This balance reduces the likelihood of significant losses in your overall portfolio. Even a simple combination of a few rental properties alongside gold coins or ETFs provides meaningful protection against volatility.

Consider a practical scenario: $200,000 invested in two rental properties and $20,000 in gold. If property values drop by 5%, your portfolio loses only a fraction of total value, while the gold helps offset volatility. Diversification allows you to reinvest gains from one asset into another, creating a balanced, steadily growing system that reduces risk without limiting opportunity.

4. Invest in Precious Metals

Precious metals like gold, silver, and platinum aren’t just collectibles, they’re a way to protect and preserve wealth. Unlike cash or stocks, metals hold value even when markets fluctuate. Gold, in particular, has been a trusted store of value for thousands of years. Over the last decade, gold has averaged an annual return of roughly 6–7%, and during periods of economic uncertainty, it often rises while other assets falter.

Scott Mainzer, Owner of Mainzer Roofing, says, ““Adding metals to a portfolio is like reinforcing a roof on a property. Even when the foundation feels solid, having a protective layer ensures that unexpected shocks, whether in the market or real estate, don’t cause major damage.”

Investing in metals diversifies your holdings. For example, if real estate values drop slightly or rental income slows, gold can maintain or even increase your wealth. Many investors allocate 5–15% of their portfolio to metals as a safety net. Options include physical coins, bars, or gold-backed ETFs for convenience, providing both liquidity and security while complementing income-producing assets.

During the 2008 financial crisis, gold prices jumped from around $800 per ounce to over $1,200 within two years, protecting investors while stocks fell sharply.

Image Source: The Financial Express

This shows how holding metals alongside real estate can cushion against unpredictable swings.

The key is balance. Metals don’t generate monthly income like rentals, so they shouldn’t replace cash-flowing assets. Instead, they act as insurance, keeping your wealth secure and giving you flexibility to make smart financial moves without panic when markets shift.

5. Refinance and Optimize Loan Terms

Mortgages and loans are tools that can unlock financial flexibility and build wealth. Refinancing allows you to lower interest rates, reduce payments, or adjust terms to better align with your goals, giving you more control over cash flow and investments.

Jason Lewis, Owner at Sell My House Fast Utah, says, “Refinancing is like flipping a property, you need to understand timing and market conditions. The right adjustment can turn a loan into an opportunity to free up cash for growth.”

For example, refinancing a $200,000 loan from 7% to 6.5% saves over $50 per month, which can be used for renovations, unexpected expenses, or investments like rental properties, diversifying your portfolio.

Loan optimization isn’t just about savings, it’s about aligning debt with your long-term strategy. Shortening a loan term saves on interest, while extending terms frees up capital for investments.

Monitoring high-interest debt, prepayment penalties, and regularly reviewing lender offers ensures your financing supports growth.

Troy Chesterton, Partner of CSC Accountants, adds, “Loan optimization is about risk management. Reviewing interest structures and repayment strategies ensures financing supports long-term growth without creating stress.”

6. Build an Emergency Fund Using Alternative Assets

Having a financial safety net is crucial. Unexpected repairs, vacancies in rental properties, or sudden market shifts can strain finances. Using alternative assets to build an emergency fund ensures you have liquid options when you need them, says Rachel Sinclair, Acquisitions Director at US Gold and Coin.

Gold and silver are ideal for quick liquidity or collateral. For example, during 2020’s market turmoil, gold prices rose from $1,500 to over $2,000, allowing investors to cash in or borrow against their holdings.

Pairing metals with cash reserves and short-term investments helps you handle emergencies without selling real estate, keeping your income stream intact. Even a small emergency fund (3–6 months of expenses) in metals or liquid assets provides peace of mind, ensuring stability and resilience in your investments.

Wrapping Up

Building financial resilience takes planning, smart decisions, and a mix of strategies that work together. Property can give steady income and long-term growth, loans let you leverage opportunities without tying up all your cash, and alternative assets like gold or silver protect your wealth when markets shift.

Using these tools together creates a safety net, multiple income streams, and flexibility to handle unexpected changes.

The goal is to create a financial setup that keeps growing, withstands challenges, and gives you control over your money.