Damaris Murray: Protecting Families from Insurance Vultures

Damaris Murray offers ethical, educational insurance guidance, protecting families from predatory agents with personalized support.

By

Sep 13, 2025

The phone wouldn't stop ringing. Damaris Murray watched helplessly as yet another insurance agent called her mother-in-law, a woman living with dementia, trying to convince her she wasn't properly covered when she actually was. The relentless calls confused and frightened the elderly woman, turning what should have been protection into predatory behavior that left the family shaken and angry.

In that moment of frustration and protective instinct, Murray realized the insurance industry had a problem that went far beyond coverage gaps, it had a trust problem. Too many families were being targeted by unethical agents who saw vulnerable populations as easy marks rather than people deserving honest guidance and genuine care.

From Family Crisis to Professional Mission

Murray's path to becoming a licensed health and life insurance agent wasn't traditional. As a wife and mother of three grown children, she had spent years focused on family life. But watching her mother-in-law's distressing encounters with predatory agents sparked something deeper, a recognition that her community needed protection from the very people who claimed to offer it.

"Being around my mother-in-law, I've seen firsthand how some agents would call her relentlessly, confusing her and making her think she wasn't properly covered when she actually was," Murray explains. "Insurance can be confusing, and our community needs to be protected from unethical vultures."

That protective instinct led her to HealthMarkets five years ago, where she could channel her passion for helping families into professional expertise. Based in Georgia but licensed across Florida, Pennsylvania, South Carolina, Texas, and Louisiana, with more states on the horizon, Murray has built her practice on a foundation of education and ethical service.

The Power of Partnership and Choice

What sets Murray apart in a crowded field isn't just her personal motivation, it's her professional positioning. As a partner with one of America's largest agencies for individual and family coverage, she works with over 140 different carriers nationwide. This breadth of options allows her to remain completely objective in her guidance, a crucial advantage in an industry often criticized for pushing products that benefit agents more than clients.

"Working with so many carriers allows me to be completely objective in my guidance, and my service is totally free," Murray emphasizes. This approach directly counters the high-pressure tactics and limited options that characterize much of the insurance sales landscape.

Murray's bilingual capabilities in English and Spanish further expand her reach, allowing her to serve diverse communities that often face additional barriers when navigating complex insurance decisions. This linguistic accessibility reflects her broader commitment to meeting clients where they are, rather than expecting them to adapt to industry jargon and practices.

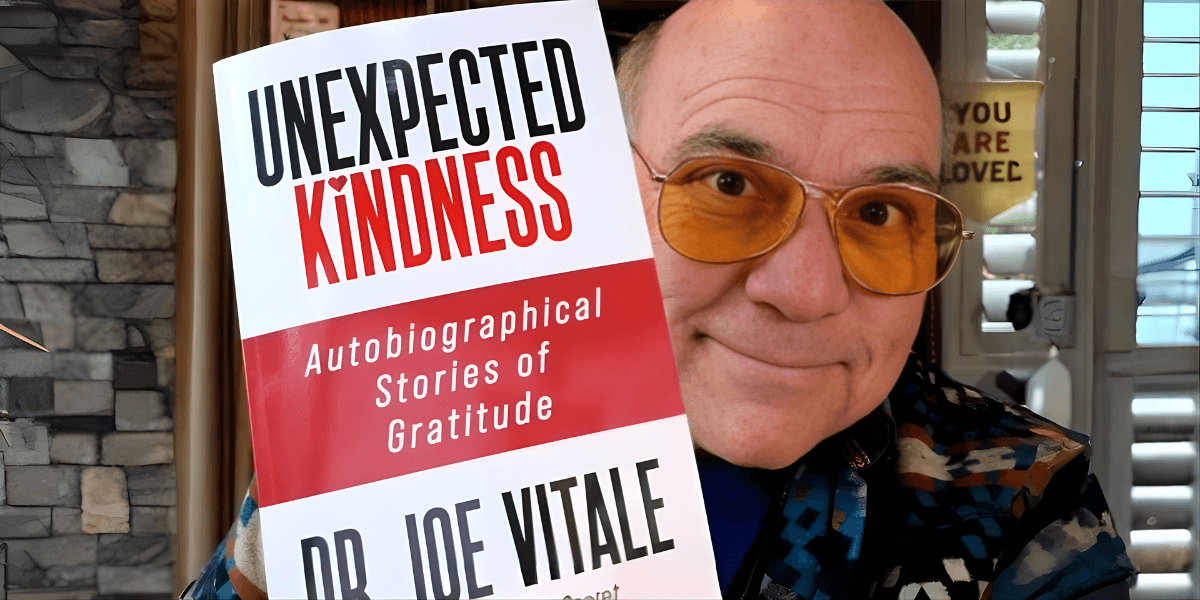

Damaris with her family

Education Over Exploitation

Murray's philosophy centers on a simple but revolutionary concept in insurance sales: education before enrollment. Rather than rushing clients toward a signature, she invests time in helping them understand their options and the long-term implications of their choices.

"I have made it my mission to teach and guide individuals and families so that they're able to make confident decisions that can transform their financial life," she explains. This transformation takes multiple forms: sharing medical bill costs instead of facing full financial responsibility, receiving checks to help pay hospital costs and emergency room visits, qualifying for tax credits that lower monthly payments, and even accessing life insurance benefits while still alive in cases of terminal or chronic illness.

Her educational approach extends to less obvious but equally important financial strategies, such as growing children's savings with compound interest, what she describes as "having their savings account on steroids", tax-free and with additional benefits that many families never realize are available to them.

A Different Kind of Service Model

In an industry notorious for post-sale abandonment and information sharing that leads to endless follow-up calls, Murray has built her practice on opposite principles. Her clients work exclusively with her, without the fear of having their information shared with other agents who might disrupt their peace with unwanted contact.

"I love what I do, so when a client works with me, it's just me," she states. "They won't have a bunch of other agents calling them because I won't ever share their information." This commitment to privacy and exclusive service reflects her understanding that insurance decisions are deeply personal and that trust, once established, must be carefully protected.

Murray's dedication extends well beyond the initial sale. She remains available to answer questions, assist with claims, and provide ongoing support as clients' needs evolve. This long-term relationship approach stands in stark contrast to the transactional model that dominates much of the industry.

The Philosophy Behind the Practice

Murray's approach is guided by a quote from entrepreneur Jack Ma: "Buying insurance cannot change your life, but it can prevent your lifestyle from being changed." This perspective shapes every client interaction, focusing not on dramatic promises but on practical protection that preserves what families have worked to build.

Her method involves learning about clients' long-term personal and financial goals, then creating plans focused on their specific needs and what's best for their family and financial situation. This personalized approach requires more time and effort than one-size-fits-all sales tactics, but it produces outcomes that actually serve client interests.

As an empty nester hoping for grandchildren, Murray brings a generational perspective to her work, understanding that insurance decisions today will impact families for decades to come. Her experience caring for her mother-in-law with dementia has deepened her appreciation for the vulnerability that comes with aging and the importance of having protections in place before they're needed.

Building Trust in an Industry That Needs It

Murray's LinkedIn profile and Facebook presence reflect her commitment to transparency and accessibility, qualities that have become her calling cards in a profession often marked by opacity and high-pressure tactics.

Her success demonstrates that there's a market for ethical, educational, and relationship-focused insurance services. Clients respond to her approach because it addresses their real concerns: understanding what they're buying, knowing they're getting objective advice, and having ongoing support when they need it.

If you're tired of dealing with agents who see you as a commission check rather than a person with unique needs and concerns, Damaris Murray offers a different path. Her commitment to education, ethics, and long-term relationships means you'll have a partner who's invested in protecting what matters most to your family, without the confusion, pressure, or unwanted follow-up calls that have given the industry such a poor reputation.