Designing Retirement Income That Holds Up in Turbulent Times

How a protected Retirement Income Master Strategy provides stability & peace of mind in times of uncertainty.

By

Feb 1, 2026

A Conversation With Brady Schmidt

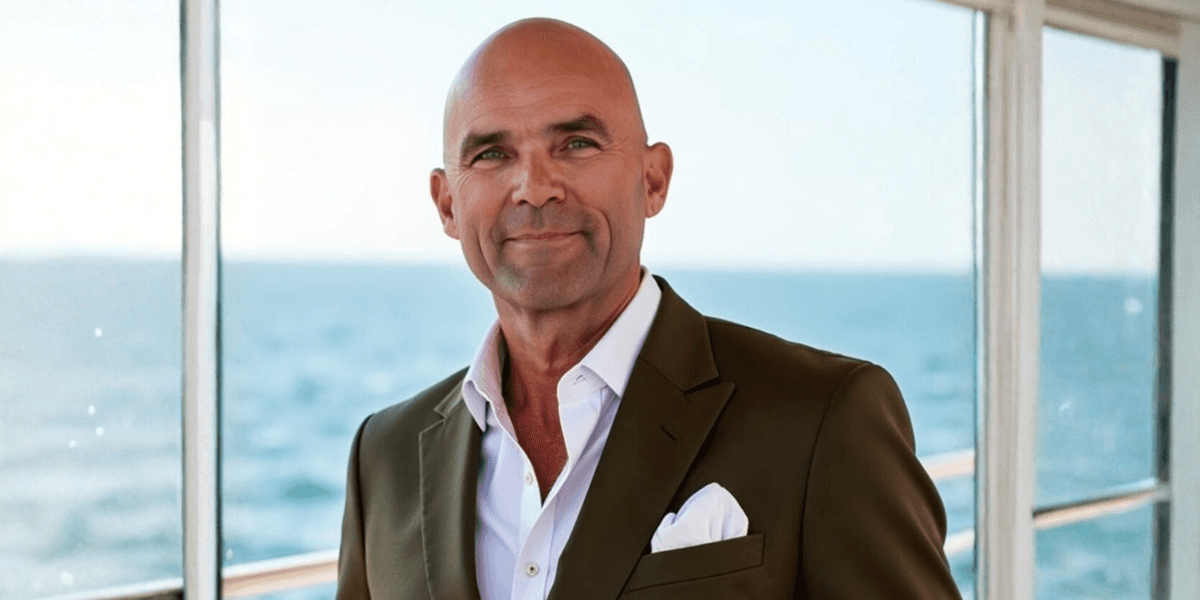

We spoke with Brady Schmidt, President and CEO of Harvest Income Solutions & Insurance Services, who was recently voted Best of the Best in Los Angeles for Retirement Income Planning, about how he helps people 55–75 create a drama free retirement

Q: Why does retirement feel more stressful than it should?

Schmidt:

Stress stems mainly from uncertainty, information overwhelm, conflicting advice, and fear of making a mistake. Pensions, IRAs, 401(k)s & Social Security each have their own set of rules requiring choices that may be permanent. Making wise choices is very crucial at this stage. I help retirees understand those rules and options for safely maximizing income without having problems down the road.

Q: Who do you typically work with?

Schmidt:

I work exclusively with people between 55 and 75 who are within 5 years of or in retirement & prefer safety over speculation. More retirees are not only seeking greater clarity these days, but also a retirement specialist who will work with them to create a financial blueprint they can feel confident and secure about in retirement

Q: How did your approach to retirement planning develop?

Schmidt:

A retired executive came to see me in 2008 after listening to my radio show. In 2007 he and his wife were taking $50,000 a year from a $1.8 million portfolio, less than a 3% withdrawal rate, below the industry standard of 4%. They had assets & a portfolio but no real plan. An advisor positioned them for aggressive growth which was great until it wasn’t. Though there were plenty of indications a market correction was on the horizon they made no defensive adjustments. As they told me, “We had no idea our portfolio was so risky.” They now had about $900,000, were shaken to the core and ultimately had to make drastic changes to their income and lifestyle. Experiences like that only served to strengthen my resolve to help retirees know there are strategies that can help them avoid circumstances that can create stress in retirement

Q: Is that what led to the Protected Income Master Strategy?

Schmidt:

Yes. The idea is very simple: understand where income will come from, how reliable it is, and how it’s designed to hold up over time. It’s not about complexity or speculation. It’s about confidence. It’s about knowing your assets will grow when markets are growing while being protected from loss when markets are declining. It’s very reassuring to know your income will always be secure and dependable in good times and bad

Q: Is retirement planning about more than investments?

Schmidt:

Great question. I’ve worked with hundreds of people in my career. The majority of those I met with had investments and multiple sources of income, but very few had a true retirement blueprint. Without a personalized, well-thought-out plan, people are leaving their financial future to chance. That’s why I won’t discuss investments until a plan is established. Would you work in a building that was thrown together without a blueprint? Confidence and peace of mind come from a clear strategy. The edge I have over the big firms, as owner of a boutique agency, is that I place a high priority on relationships and on the principles that safety is first & plan precedes portfolio.

Q: What challenges do retirees face when transitioning into retirement?

Schmidt:

Finding the right advisor to work with can be a challenge. General practitioners and novices far outweigh seasoned specialists in retirement planning for people 55 to 75. Procrastination is often a hurdle as well. Google search “retirement” and you’ll get millions of options. Trust, complexity & fear of making a mistake can lead to indecisiveness & without clarity, people get stuck. My role is to slow things down, simplify the picture, and help people clearly understand their options, because clarity leads to confident action and less stress.

Q: Education seems central to your approach. Why is that important?

Schmidt:

People shouldn’t feel pressured into decisions they don’t understand. When people are given the time they need to know how their income works, in an environment where questions and concerns are addressed, and respected, they feel more confident in their decisions and more in control. Education, communication & understanding eliminates the unknown. That confidence reduces stress and leads to better, more informed and accurate financial decisions.

Q: Is retirement planning a one-time event?

Schmidt:

No. The Drama Free Retirement is built on a combination of expertise, strategy alignment and relationship. It’s a roadmap to successfully reach milestones, the three phases of retirement. It’s a certainty that health, economies, markets, legislations & family circumstances will change. The strategies I implement, though free of stock market risk, do need regular review and adjustment to keep the plan aligned with evolving needs and preserve confidence and peace of mind over time. To achieve long-term success, it’s important for a retiree to work with an advisor who is committed to the journey with them. It’s a very important relationship.

Q: What principles and values guide your work?

Schmidt:

There are three. Principle number one: Safety First meaning principal protection from Stock Market Risk. Second, a reliable and predictable income that will last for life & Third, simplicity. Retirement plans should be understandable and manageable, not complicated. Values that accompany these principles are respect, transparency, ethics & putting the clients best interest first. I also place a high priority on providing exceptional service and remaining accessible after a new client comes on board.

Q: What does a successful retirement look like to you?

Schmidt:

A successful retirement is one where people feel confident and at peace, regardless of the headlines. There’s no fear of the bottom falling out or unpleasant surprises. That’s what I call a Drama-Free Retirement, and it’s been my passion to help retirees enjoy retirement with true financial security.

This is what a successful retirement looks like, in the words of an actual client of 25 years:

“After losing my husband, I felt overwhelmed by financial decisions. Brady explained everything clearly and helped me get my finances organized and safe during a difficult time. What matters most is knowing I have someone I trust to guide me, and I've always felt secure in my retirement over all these years.”

Marianne M., Northridge, CA

The Bottom Line

In an uncertain economic environment, secure retirement planning isn’t about chasing returns, it’s about clarity, predictability, and peace of mind. With the right income strategy, retirement can become what it was meant to be: a time to enjoy life and to reap an abundant harvest from years of dedication and disciplined saving.

Brady Schmidt, President and CEO of Harvest Income Solutions & Insurance Services, helps people aged 55 to 75 who prefer a safer approach to retirement planning.

CA DOI License #0632846

Learn More:

Disclosure

This is for informational purposes only. It is not an offer to buy or sell securities or to invest or purchase any investment product. Brady does not provide securities, legal or tax advice,for these services refer to your respective professional.