EcoMoat: Unlocking Competitive Advantage With AI

EcoMoat is redefining investment research by making economic moat analysis more objective, accessible, and trustworthy for long-term investors.

By

Jan 9, 2026

A New Vision for Investment Research

NATIONWIDE - JANUARY 2026 - (USAnews.com) Michael Shmilov still remembers the first time he stared at a spreadsheet of financial data and felt the disconnect between numbers and narrative. As a seasoned product leader, he had spent years building platforms used by millions. Yet when it came to investing, research felt fragmented and outdated. Traditional analyst reports leaned heavily on opinion, while a new wave of AI tools rushed to generate quick predictions and not always grounding their conclusions in fundamentals.

That tension led to EcoMoat.

Rather than using AI to forecast short-term price movements, EcoMoat focuses on a principle that has guided successful investors for decades: the economic moat. Warren Buffett famously argued that long-term investment success depends less on quarterly earnings beats and more on whether a business has durable advantages that protect profitability over time.

EcoMoat brings that philosophy into the AI era. By starting with structured financial data, income statements, balance sheets, cash flows, and earnings transcripts, and only then applying AI to explain, summarize, and surface insights, the platform aims to keep research disciplined and transparent.

“Most AI tools jump straight to conclusions,” says Shmilov. “EcoMoat starts with fundamentals, clean data, ratios, transcripts, and uses AI as an interpreter, not a shortcut. That’s how research stays trustworthy.”

The Origin Story: From Product Leadership to Independent Builder

Before founding EcoMoat, Shmilov spent over a decade leading large-scale products as a VP of Product. He worked with global teams, vendors, and complex organizations, shipping platforms that reached massive audiences.

EcoMoat began as a different kind of challenge.

“With EcoMoat, I wanted to prove that today a single builder can design, build, and ship something genuinely useful, something that previously required entire analyst teams,” he explains.

That independence shaped the platform’s identity. Instead of competing with traditional analyst firms on volume or with AI trading tools on speed, EcoMoat focuses on depth, consistency, and clarity. It shows how lean, focused innovation can stand alongside institutional research, without mimicking its opacity or cost.

Why Moats Matter

At the heart of EcoMoat is a simple belief: moats matter more than narratives.

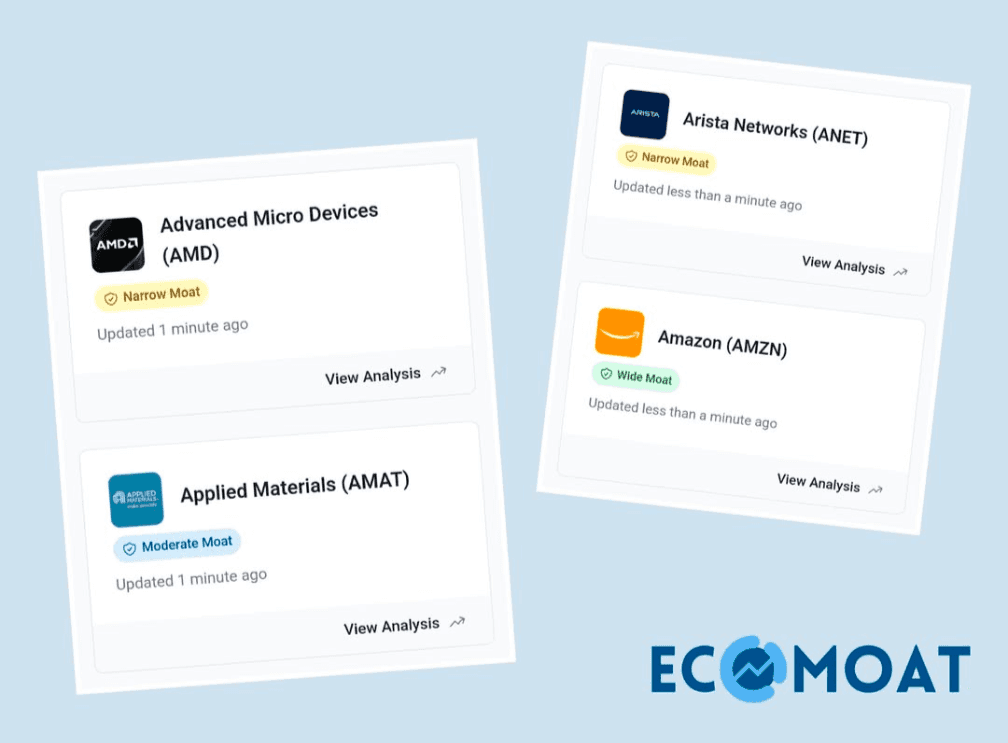

The platform evaluates eight core sources of competitive advantage, including brand strength, network effects, cost leadership, switching costs, intangible assets, efficient scale, distribution power, and emerging data or AI advantages.

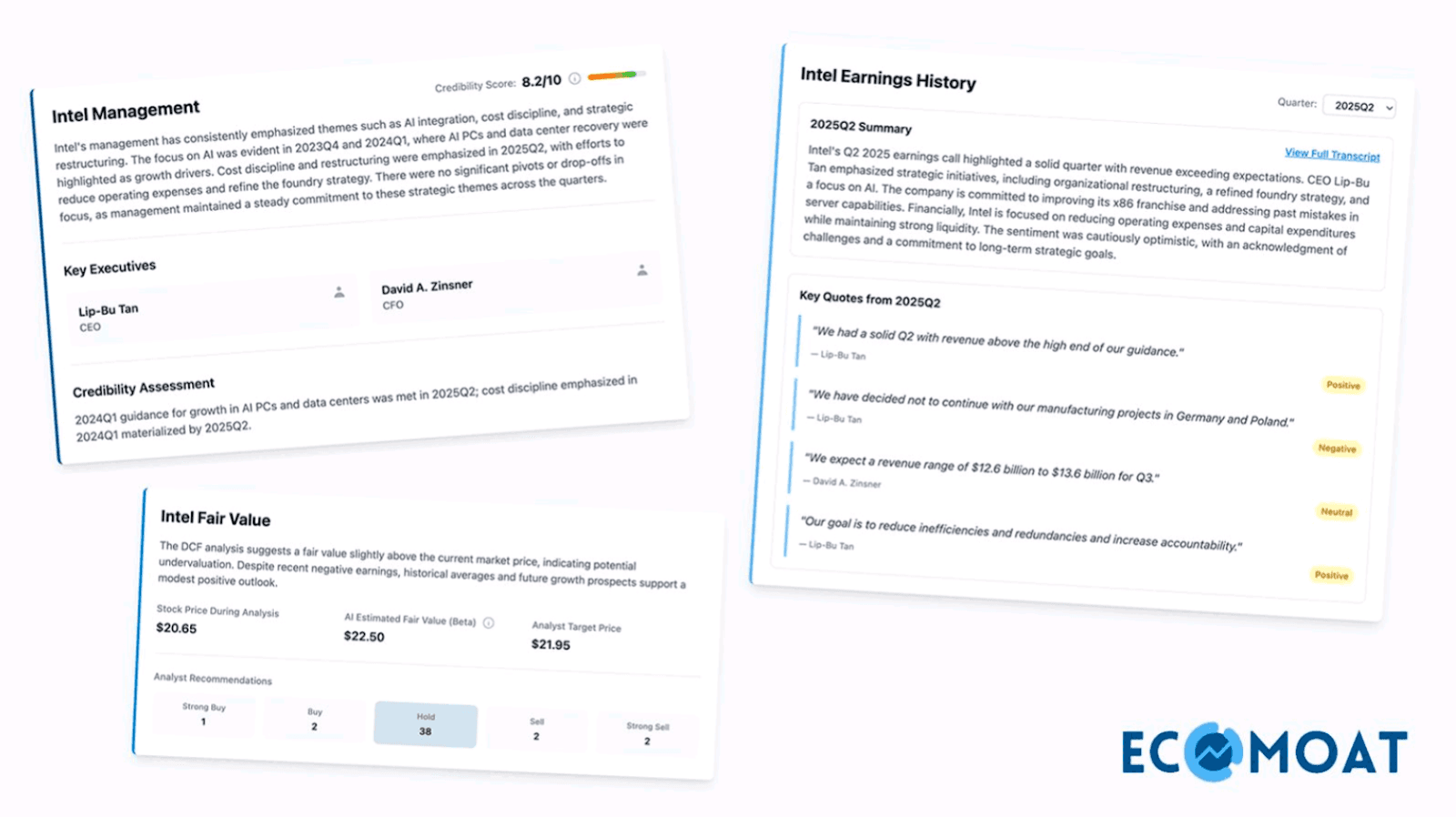

EcoMoat refreshes its analysis regularly across the S&P 500, ensuring that moat ratings, fair value estimates, and management credibility scores remain current and comparable. Investors can see not just whether a company is profitable today, but whether its advantage appears resilient enough to withstand competition and economic cycles.

“EcoMoat is not about stock tips; it helps you understand the durability of a business,” Shmilov notes.

This approach shifts the focus away from short-term performance and toward long-term conviction, helping investors evaluate businesses as enduring enterprises, not just tickers.

Trust and Objectivity in the AI Era

Investment research has long struggled with bias. Human analysts bring incentives and opinions. Many AI tools, meanwhile, risk hallucinations or shallow analysis.

EcoMoat is designed to sit between these extremes, aiming to ground insights in structured financials and primary sources, including earnings transcripts and actual performance. AI is used to synthesize and interpret that information, not replace it.

One example is EcoMoat’s management credibility scoring. The platform compares what management teams have said in past earnings calls with what the company later delivered, adding an accountability layer that traditional research often ignores. Or not being consistent about it.

Democratizing Access to Institutional-Grade Research

For decades, high-quality investment research has been locked behind expensive subscriptions. EcoMoat challenges that model.

“Research shouldn’t live behind a $1,000 paywall,” Shmilov emphasizes. “EcoMoat makes moat and fair-value analysis accessible, so more investors can make decisions with clarity instead of guesswork.”

The platform is free to access, creating a level playing field between retail investors and professionals. Monetization is planned through advanced research tools that are currently being tested, while the core research remains open and consistent for all users.

Human + AI, Not Human vs. AI

EcoMoat does not claim to replace human judgment. Instead, it was designed as a complementary tool, a fresh set of unbiased signals to challenge assumptions.

“EcoMoat isn’t about telling you what to buy, it’s about giving you fresh, unbiased signals to strengthen your own research. The best investors combine human judgment with tools that challenge their assumptions,” Shmilov explains.

This humility is intentional. By positioning itself as a support system rather than an oracle, EcoMoat avoids the pitfalls of overpromising.

What Sets EcoMoat Apart

EcoMoat sits at the intersection of traditional fundamental analysis and modern AI:

Grounded in Fundamentals: Every insight starts with clean, structured financial data.

Moat-First Focus: Competitive durability takes precedence over short-term signals.

Consistent Refreshes: Analysis evolves as new earnings and disclosures emerge.

Accessible by Design: High-quality research is available to everyone, not just institutions.

Today, EcoMoat focuses on S&P 500 companies. Looking ahead, the platform aims to expand beyond single-company analysis toward broader market intelligence, enabling investors to explore patterns across sectors, identify emerging competitive dynamics, and conduct deeper research with AI as a structured assistant.

In an investment landscape crowded with noise and speculation, EcoMoat’s goal is simple: help investors focus on what lasts.

Discover how EcoMoat can sharpen your research and deepen your conviction. Visit EcoMoat.ai, join the conversation on X, or connect with the team on LinkedIn.