Fairclough Palmer AG: Strategic CHF 285M Banking Acquisition in Montenegro

Fairclough Palmer AG sets its sights on Montenegro's banking sector with a CHF 285M investment to reshape the European market.

By

Oct 8, 2025

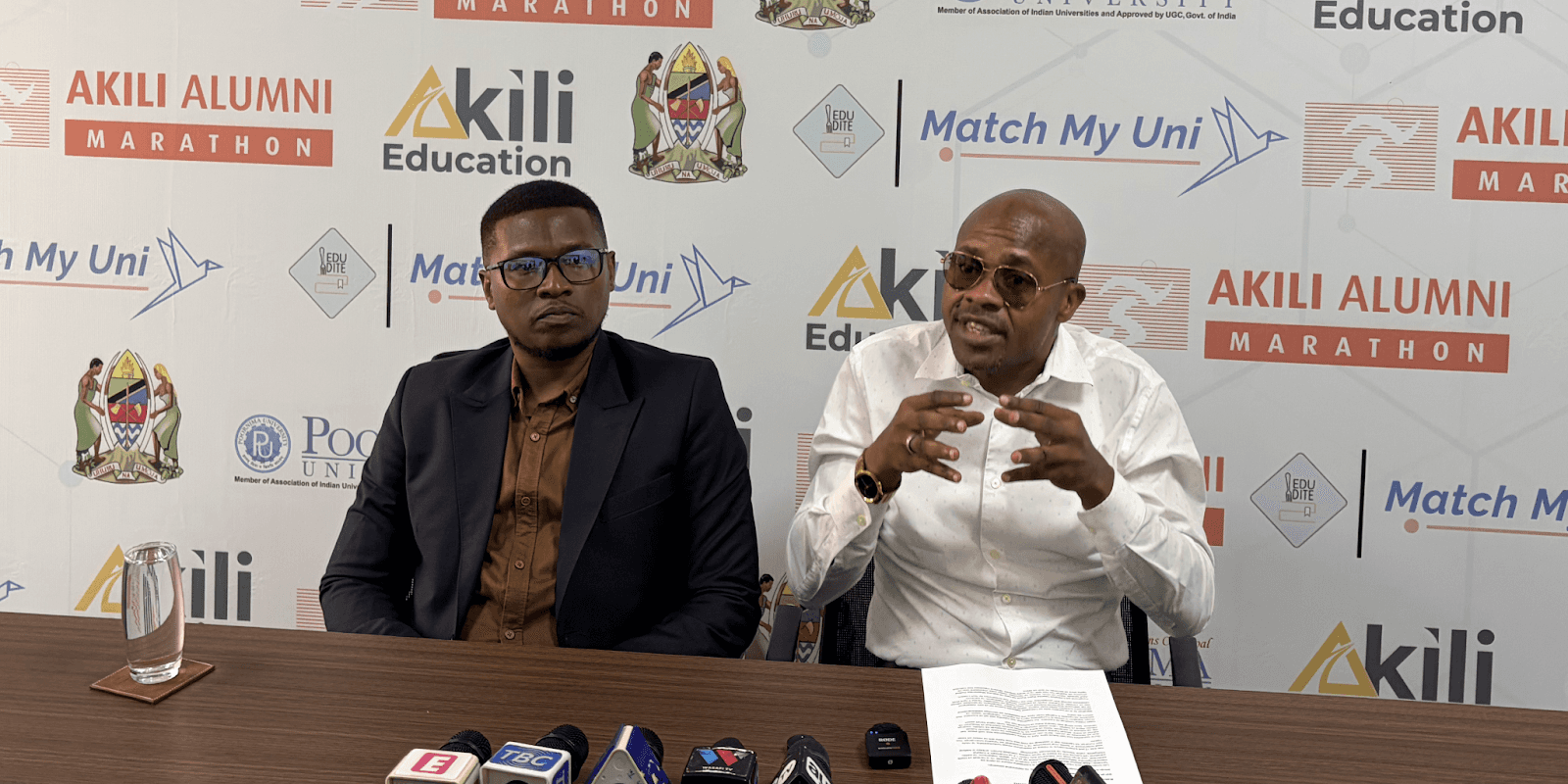

NATIONWIDE - OCTOBER 2025 - (USAnews.com) In the ever-evolving world of finance, where many players are chasing fleeting returns, Fairclough Palmer AG stands firm with a strategy that is often considered “boring” but yields results. The Swiss investment firm, co-founded by Frankie Palmer, is betting big on stability, long-term growth, and strategic acquisitions. The firm’s latest move is poised to make waves in the European banking landscape. By 2026, Fairclough Palmer plans to channel CHF 285 million into Montenegro’s economy, with a bold acquisition strategy that will forever change the country’s financial landscape.

The Journey of Fairclough Palmer AG:

Fairclough Palmer AG may be new to the Swiss investment scene, having only been formally established in January 2025, but its roots go deeper. The firm was born from the legacy of an institution founded in Saint Vincent and the Grenadines in 2021. This transformation signals a shift in the company’s strategy, one that embraces both traditional investment philosophy and ambitious modern goals.

The firm’s primary objective is clear: to become the Berkshire Hathaway of Switzerland, combining a time-tested value investment philosophy with strategic acquisitions. Central to its business model is the goal of acquiring fundamentally strong companies with competent management, businesses that provide long-term value, and those that possess a clear competitive edge. Fairclough Palmer AG avoids speculative ventures, focusing instead on proven, stable businesses.

This philosophy extends to their latest initiative, a CHF 285 million investment aimed at transforming the Montenegrin banking market. At the heart of this strategy lies the acquisition of five major banks. A pre-identified primary bank will serve as the central hub, into which the other four banks will merge. This consolidation will result in the creation of a single, robust banking brand with an industry-leading presence. Fairclough Palmer AG aims to capture 40% of the Montenegrin market, positioning the firm as a key player in the country’s banking future.

The 2026 Initiative:

The Montenegrin expansion is just the beginning. The CHF 285 million acquisition plan is a calculated move that will see Fairclough Palmer AG not only seize control of a significant portion of the Montenegrin banking market but also establish a launchpad for broader European dominance. The firm’s ambition is to acquire additional banks across Europe, eventually creating a unified banking brand that spans the continent. The consolidation plan will be executed with precision and discipline, ensuring that each acquisition serves to reinforce the company’s long-term vision.

To fund this transformative move, Fairclough Palmer AG is raising CHF 100 million through a Convertible Loan. This investment instrument offers a fixed annual return of 7%, with all interest paid at maturity. Investors also have the option to convert their loans into equity at maturity, receiving a 20% discount on the firm’s share price. This unique investment opportunity offers an attractive risk-to-reward ratio, giving investors direct exposure to a strategically aligned portfolio of assets.

The Swiss-based firm’s approach is designed to offer a higher level of security to investors, leveraging Switzerland’s renowned stability, political neutrality, and pro-business environment. By focusing on high-quality assets and strategically avoiding speculative ventures, Fairclough Palmer AG ensures that its investors benefit from predictable returns while maintaining the firm’s long-term vision.

What Sets Fairclough Palmer AG Apart:

At the core of Fairclough Palmer AG’s success lies its unwavering commitment to a “boring” but time-honored investment strategy. While many financial institutions chase high-risk opportunities and short-term gains, Fairclough Palmer sticks to the fundamentals. It believes that investing in companies with solid financials, competent leadership, and a proven track record of sustainable growth is the key to achieving long-term, compounding returns.

This philosophy has earned the firm a reputation for stability in a world often obsessed with instant gratification. Fairclough Palmer’s investments are guided by the principle that slow, consistent growth is far more valuable than the volatility of speculative investments. For investors, this approach offers a unique opportunity to benefit from the disciplined strategies of Warren Buffett and Charlie Munger, applied to a modern European context.

Additionally, Fairclough Palmer AG offers an edge that few competitors can match: zero fund management fees. As a holding company, rather than an investment fund, the firm bypasses the typical fees associated with fund management, ensuring that investors retain more of their returns. This structure is particularly appealing to those seeking transparency and direct exposure to valuable assets without the additional financial burdens imposed by traditional fund managers.

Award Recognition: Fairclough Palmer AG's Achievements in 2025

Fairclough Palmer AG has been recognized as the Best Strategic Advisory and Boutique Investment Firm in Switzerland of 2025 by Best of Best Reviews. This prestigious accolade celebrates the firm's excellence in providing strategic advisory services and its adept management of public and private equity investments. Fairclough Palmer AG's commitment to sustainable growth, strong corporate governance, and value-driven investments has solidified its position as a leader in the Swiss financial sector. This award highlights the firm’s outstanding contribution to reshaping the investment landscape and its continued success in delivering significant value to its investors.

Looking to the Future:

Fairclough Palmer AG’s ambitious plans don’t stop with Montenegro. The firm’s 2026 initiative is just the first phase of a broader European strategy that will see the company acquire more financial institutions across the continent. The Montenegrin consolidation is set to act as a catalyst for future acquisitions, enabling the firm to build a diversified portfolio of banking assets that spans multiple European countries.

Moreover, the firm’s investment in Montenegro is expected to generate an annual profit of CHF 17 million, which will be reinvested into further strategic acquisitions. This reinvestment strategy not only strengthens Fairclough Palmer’s position in the market but also creates a self-sustaining cycle of growth and value creation.

In the years to come, Fairclough Palmer AG will continue to build its reputation as a reliable, long-term investor that prioritizes value over speculation. The firm’s goal is to create a lasting legacy in the European banking market, one that reflects the firm’s commitment to discipline, integrity, and financial excellence.

For those interested in learning more about this unique investment opportunity, Fairclough Palmer AG invites you to explore the details of their CHF 100 million convertible loan offering. With a stable return, zero management fees, and a compelling growth strategy, this investment opportunity is designed to appeal to those seeking a secure, long-term return in the world of European banking.

Visit Fairclough Palmer AG to discover how this opportunity can fit into your investment portfolio. Take the first step in joining a firm that is redefining the landscape of value investing.

For direct inquiries and further information on the CHF 100 million convertible loan, please refer to the investment proposal.