Perp DEXs Are Stealing Billions From CEXs – And Mithril’s Execution Layer Is Leading the Charge

Perpetual DEXs are pulling billions from centralized exchanges, but a new execution layer by Mithril is emerging to tackle the complexity of advanced trading strategies.

By

Jan 27, 2026

Perpetual decentralized exchanges (perp DEXs) have rapidly become one of the most significant trends in the world of crypto trading. In just the last year alone, they’ve managed to pull billions of dollars in trading volume away from centralized exchanges (CEXs), driven by advantages such as transparent on-chain settlement, incentive structures, and decentralized control. But as these platforms continue to grow, a new challenge has emerged, execution.

Advanced trading strategies like market making, delta-neutral funding trades, grid systems, and momentum scalping are highly effective. However, their complexity presents a bottleneck. Setting up, monitoring, and iterating on these strategies requires substantial technical infrastructure. The issue isn’t that traders lack ideas, but rather the tools and systems necessary to implement those ideas reliably and at scale.

This is where Mithril is stepping in.

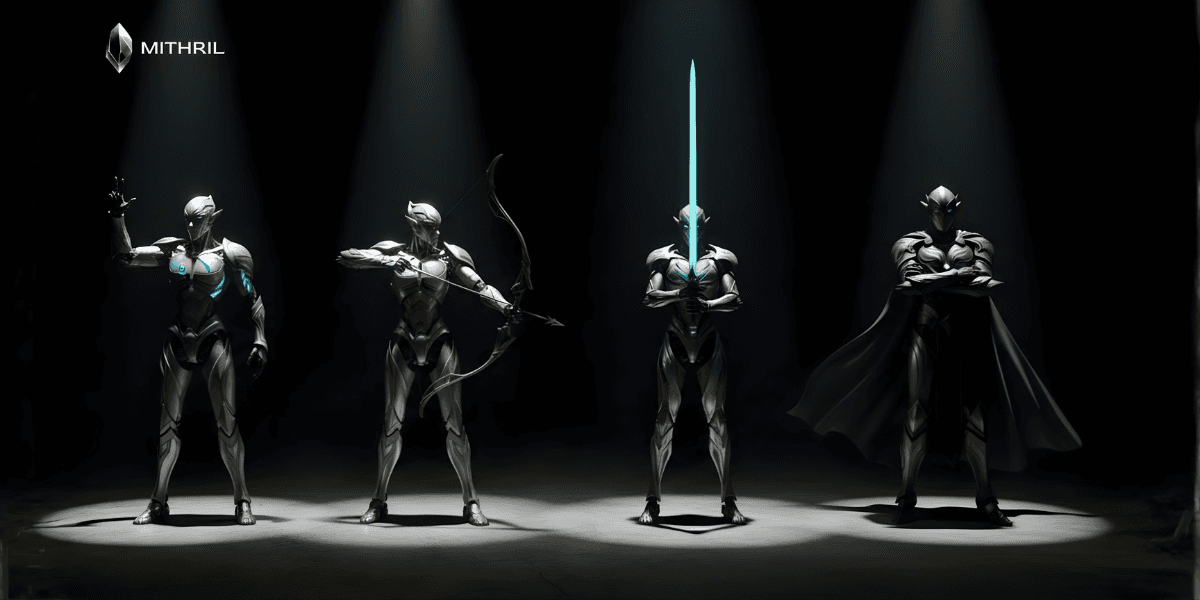

A New Execution Layer for Perp DEX Trading

Mithril is positioning itself as the execution layer for perpetual trading, providing the infrastructure necessary to deploy complex strategies without the typical barriers to entry. Rather than forcing traders to manually configure wallets, APIs, parameters, risk management systems, and monitoring tools, Mithril compresses all of this functionality into a single, streamlined interface.

At the heart of Mithril is customizable automated trading bots powered by AI-assisted tools. These bots allow traders to configure, monitor, and iterate on their strategies with ease. Mithril’s focus is on execution, not prediction, making it easier for traders to go from strategy design to deployment without the need for specialized knowledge in trading infrastructure.

Full custody stays with traders: Funds never leave the exchange; they remain under the trader’s control.

Bots trade directly via API: Mithril’s bots execute strategies through API connections to exchanges, providing seamless interaction without intermediaries.

Mithril never takes custody: At no point does Mithril hold or control user funds, ensuring complete transparency and security.

By removing the technical friction typically associated with complex trading setups, Mithril is lowering the entry barrier for advanced and “exotic” strategies that were once reserved for highly technical traders. With Mithril, traders can deploy strategies they previously might have been unable to execute due to infrastructure limitations.

Traction That Speaks for Itself

Mithril is not a theoretical product or a demo, it’s already making waves in real markets.

Since its official launch on November 11, 2023, Mithril has generated over $130 million in live trading volume. This impressive figure has been driven by real usage, not speculation or hype, and is growing rapidly.

Key milestones include:

$130M+ in live trading volume since launch

Consistent daily volume growth

Hundreds of bots deployed, tuned, shut down, and rebuilt in production

New users onboarded daily, with the product gaining traction organically

Even more remarkable is the fact that Mithril has achieved all this without venture capital funding or token sales. The company is bootstrapped and growing entirely through product utility, community feedback, and real market usage. This organic growth is a testament to the value Mithril provides to real traders, not just speculators or investors.

From Points Farming to a Trading Command Center

Mithril’s initial success was accelerated by the points farming meta on perp DEXs, a popular tactic in the early stages of adoption. However, Mithril’s platform is evolving beyond that niche. It is rapidly becoming a command center for traders, designed to:

Surface opportunities across multiple perp venues: Traders can now identify and act on trading opportunities that span various decentralized exchanges.

Match opportunities with the right strategy: Each opportunity can be paired with an optimal strategy, tailored to the conditions of the market and specific parameters.

Execute with low latency: Fast, efficient execution, even in volatile markets, is essential for capturing profits.

Adapt to changing market conditions: Continuous monitoring ensures strategies are adjusted dynamically as market conditions shift.

In a market that is increasingly fragmented and fast-moving, execution quality is becoming a key competitive advantage. Mithril is positioned to lead the way by providing traders with the tools they need to act on opportunities without getting bogged down by technical hurdles.

Is Mithril the Future of Crypto Trading?

As perpetual DEXs continue to scale and markets become more complex, automation and AI are no longer optional, they are foundational. Mithril sits at the intersection of automation, AI-assisted strategy design, and multi-venue execution, making it a pivotal player in the future of crypto trading.

Whether Mithril goes on to become the next unicorn or defines an entirely new category of trading infrastructure, one thing is already clear: the execution layer is emerging as a critical part of the trading stack.

Mithril has real volume, real users, and real momentum, and it’s quickly positioning itself as the go-to solution for crypto traders who want to execute complex strategies with ease.

The future of crypto trading is here, and it’s powered by execution.

To learn more about Mithril and get started with automated trading, visit Mithril.money, check out their bot interface, or join the community on X, Telegram, and Guild.

Disclaimer:

This article is for informational purposes only and is not intended to promote, encourage, or provide professional advice related to cryptocurrency trading or decentralized exchanges. Always consult a qualified professional or trusted authority before engaging in any activities related to cryptocurrency, trading strategies, or investments, especially if doing so may have legal, financial, or personal consequences. The author and publisher are not responsible for any losses, damages, or outcomes resulting from the use or reliance on the information provided.