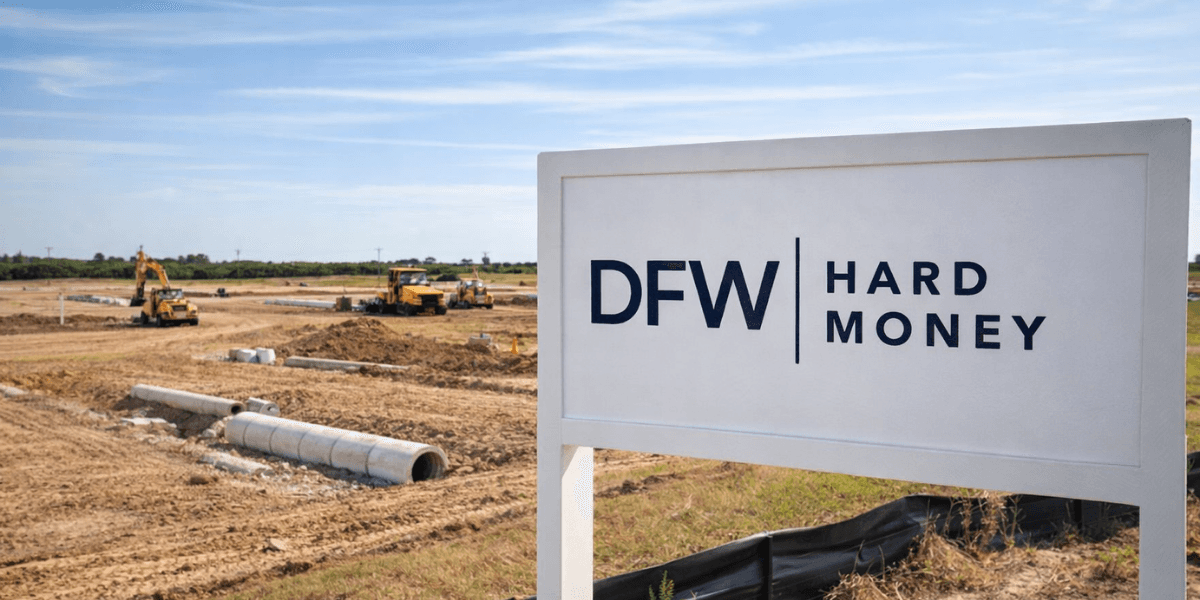

Texas Private Lending Market Expands as DFW Hard Money Increases Focus on Land Development Financing

DFW Hard Money leads the charge in expanding Texas' land development financing, providing new opportunities for developers across the state.

By

Jan 30, 2026

Texas Private Lending Market Expands as DFW Hard Money Increases Focus on Land Development Financing

The Texas private lending market has seen significant changes in recent years, with more developers turning to alternative lending sources to finance their projects. A key player in this growing trend is DFW Hard Money, a company that has been reshaping land development financing across the Lone Star State. By focusing on funding land development projects, the company is not only helping developers but also boosting the Texas economy through innovative solutions and a personalized lending approach.

For John Pribble, co-owner of DFW Hard Money, the mission was clear from the beginning: help developers secure the capital they need to bring their visions to life. “We realized there was a major gap in the lending market for land development projects,” Pribble explains. “Land developers often struggled to secure traditional financing due to the unique nature of their projects. We saw an opportunity to step in and provide the support they needed.”

From Humble Beginnings to Industry Leadership

Founded with a commitment to supporting Texas developers, DFW Hard Money quickly became a trusted partner for real estate investors and developers seeking reliable, flexible financing. The company’s unique approach combines deep local knowledge with the flexibility that traditional banks often lack.

In the early years, the business faced typical challenges: convincing developers to trust a new player in an established market and navigating the complexities of real estate lending. But over time, DFW Hard Money earned its reputation through consistent results, proving that its focus on land development was not only viable but essential for the growth of the Texas real estate market.

“We’ve always been about relationships,” Pribble says. “It's not just about the deal, it's about understanding the developer's goals and helping them achieve success. Our hands-on approach has set us apart from other lenders.”

The Turning Point: A Focus on Land Development

A pivotal moment came when DFW Hard Money decided to increase its focus specifically on land development financing. Recognizing the challenges developers face when securing funding for land development, especially in a competitive market like Texas, the company saw the need for a more tailored financial solution.

“Land development is different from other real estate projects. It involves a unique set of risks and rewards,” Pribble explains. “But it's also an area where there’s massive potential. As the state continues to grow, developers are seeking more opportunities to develop land and create communities. Our job is to provide them with the capital to make that happen.”

Today, DFW Hard Money stands at the forefront of land development financing in Texas, working with developers across the state to fund projects ranging from residential communities to commercial properties. The company’s team is well-versed in the specific needs of land developers, offering tailored solutions that help navigate the often-complex approval and permitting processes.

What Sets DFW Hard Money Apart

Unlike traditional lenders, DFW Hard Money focuses on building lasting relationships with clients, understanding their goals, and offering customized lending solutions. This flexibility is key in the fast-paced world of land development, where speed and efficiency can make or break a project.

Pribble notes, “When you work in land development, timelines are tight, and flexibility is crucial. We understand that. Our clients trust us because we offer fast, reliable financing and work with them every step of the way.”

The company’s success also stems from its deep connection to the Texas market. DFW Hard Money is committed to helping local developers thrive and contributing to the state's overall growth. With the Texas real estate market continuing to boom, DFW Hard Money’s role as a trusted lender is only becoming more significant.

A Bright Future for Texas Developers

As DFW Hard Money continues to grow and expand its influence in Texas, the company remains committed to helping developers unlock new opportunities. With more land developers turning to private lenders for the flexibility and speed they need, DFW Hard Money is poised to continue leading the charge in land development financing.

Pribble’s vision for the future is clear. “We want to continue to be a key partner for developers in Texas. Whether it’s helping them acquire land, fund infrastructure, or provide capital for larger projects, our goal is to be there every step of the way.”

For developers looking for a reliable source of capital, DFW Hard Money is quickly becoming the go-to solution for land development financing in Texas. As the state’s real estate market continues to grow, this innovative lender is ready to provide the support developers need to succeed in an increasingly competitive environment.

Ready to Start Your Land Development Project?

If you’re a Texas developer looking for the financial backing to bring your next land development project to life, DFW Hard Money can help. With a proven track record, flexible financing options, and a deep understanding of the land development process, the company is uniquely positioned to support your goals. Contact DFW Hard Money today to learn more about how they can help you turn your vision into reality.